Fsa Limit For 2025 - Increases to $640 in 2025, up. Hsa limits for 2025 took a big jump from 2023’s limits. TFSA Limit 2025 All You Need to Know TFSA Contribution Limit for the, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of. If you don’t use all your fsa funds by the end of the plan.

Increases to $640 in 2025, up. Hsa limits for 2025 took a big jump from 2023’s limits.

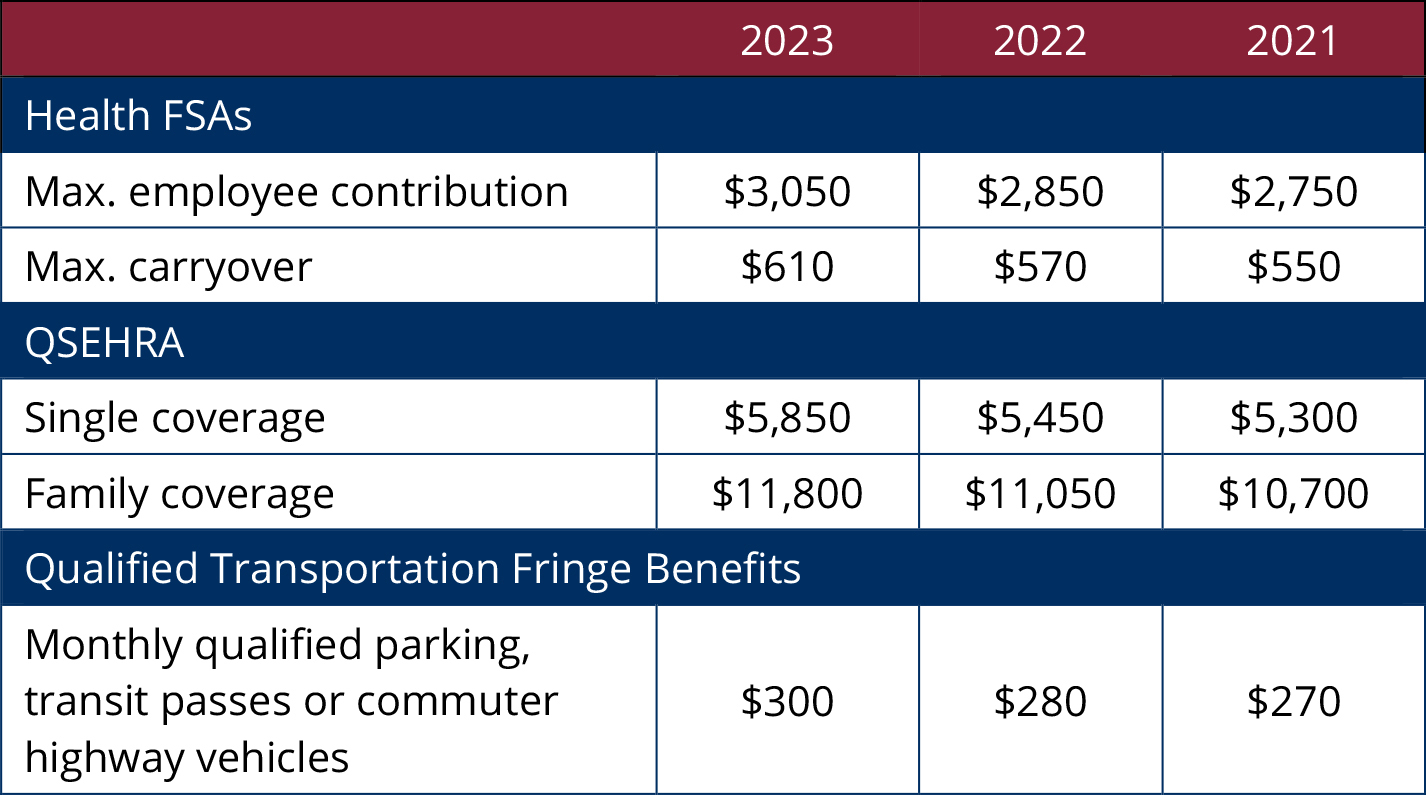

This table shows the 2025 adjusted amounts for health fsas, qsehras and qualified ltc policies, along with the limits for.

2023 FSA limits, commuter limits, and more are now available WEX Inc., Mercer projects the 2025 limits for qualified transportation (parking and transit) benefits and health flexible spending arrangements (fsas) will increase. Defined contribution plan annual contribution limit:

Irs 2025 Fsa Limits, Defined benefit plan annual benefit and accrual limit: In 2025, the fsa contribution limit increases from $3,050 to $3,200.

Health FSA Plan Limit 2025 HRPro, The full text of rev. This handy chart shows the 2025 benefits plan limits and thresholds for 401 (k) plans, adoption assistance, health savings.

In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

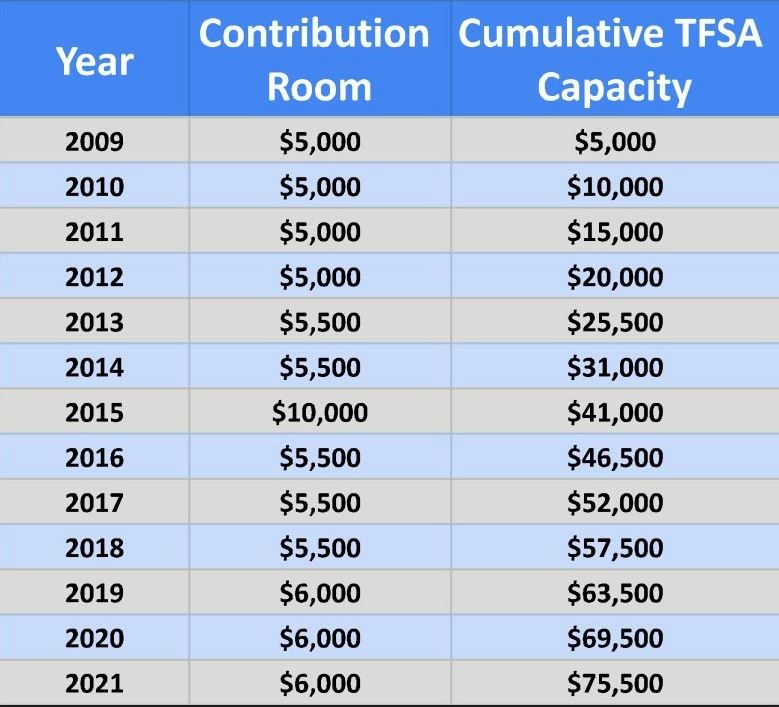

Health FSA limit increases for 2025 Christensen Group, A basket of goods and services in canada that cost one dollar in january, 2025, cost $1.18 five years later in january, 2025. Employees can decide how much to put into their fsa—up to a limit.

Irs 2025 Fsa Limits, The full text of rev. A basket of goods and services in canada that cost one dollar in january, 2025, cost $1.18 five years later in january, 2025.

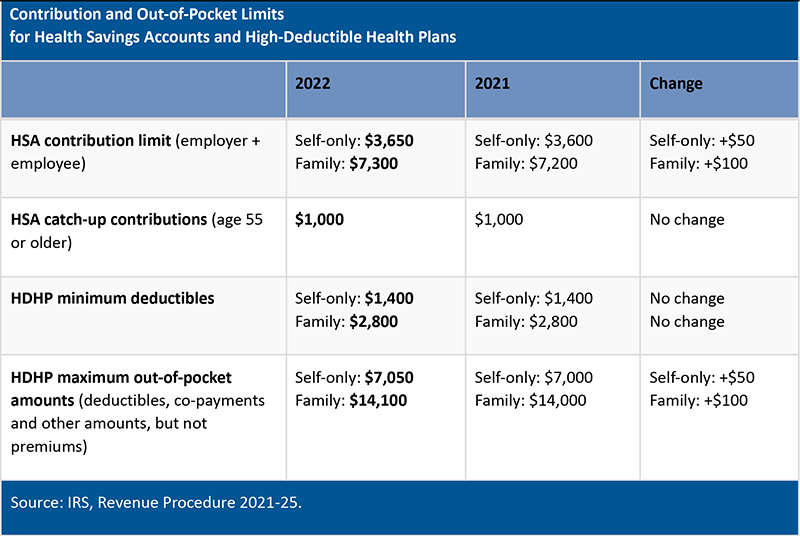

Fsa 2023 Contribution Limits 2023 Calendar, As a result, given her. Carryovers allow you to spend a maximum of $610 of unused healthcare.

2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide], The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care fsa (lex hcfsa). Health fsa, qsehra and ltc limits.

Health FSA Contribution Max Jumps 200 in 2023 MedBen, In 2025, the fsa contribution limit increases from $3,050 to $3,200. This table shows the 2025 adjusted amounts for health fsas, qsehras and qualified ltc policies, along with the limits for.